pay utah state property taxes online

They conduct audits of personal. Farmington Utah 84025 Mailing Address Davis.

Clark County Indiana Treasurer S Office

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

. Property taxes in Utah are managed through the collaborative effort of several elected county offices. Please visit this page to contact your county officials. See also Payment Agreement Request.

Property taxes can be paid online by credit card. Online PERSONAL Property Tax Payment System. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks.

The answer is yes. You can also pay online and. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks.

Online REAL Estate Property Tax Payment System. If you owe Utah state taxes the following instructions will guide you through the process of making an online payment. Payments can be made online by e-check ACH debit at taputahgov.

This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks. You may pay your tax online with your credit card or with an electronic check ACH debit. On November 30 or 2.

TAP includes many free services such as tax filing and payment and the ability to manage your account online. Click here to pay via eCheck. To find out the amount of all taxes and fees for your.

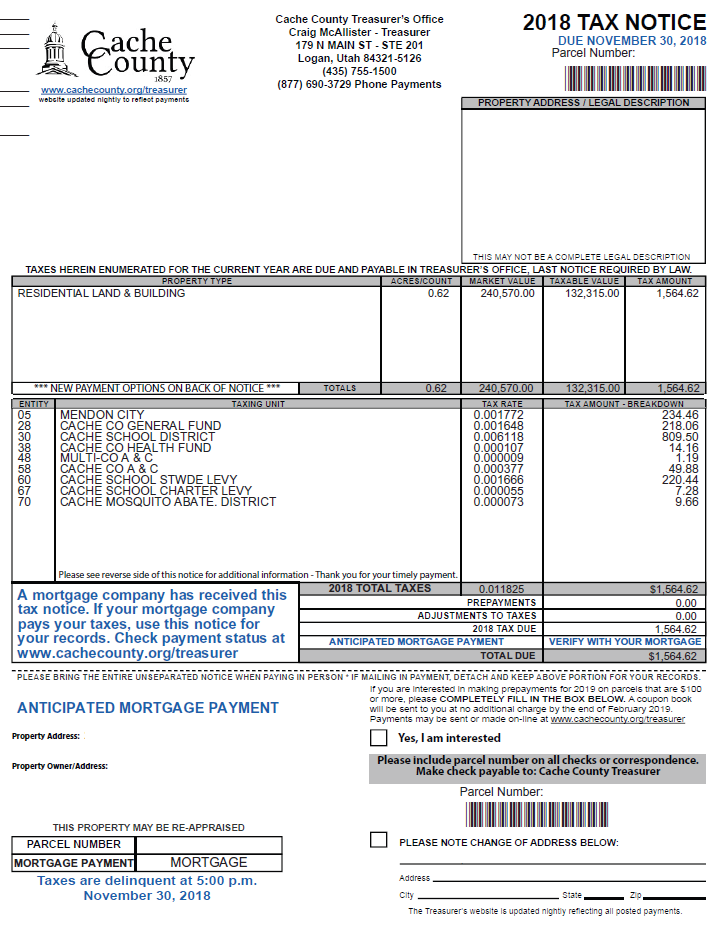

We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729 Jurisdiction Code 5450. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. In Utah residential property is exempt from.

Taxpayers paying online receive immediate confirmation of the payments made. These are the payment deadlines. You can pay your property taxes online through the.

Click the link above to be directed to TAP Utahs. If your adjusted gross income includes income from Utah sources you must pay tax on those sources on your federal return. 1 of the payment amount with a minimum fee of 100.

The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. If youre a property owner in Utah you may be wondering if you can pay your property taxes online. 0 Electronic check payment.

Filing Paying Your Taxes. Questions about your property tax bill and payments are handled by your local county officials. The Recorders Office and the Surveyors Office records the boundaries and ownership.

Be Postmarked on or before November 30 2022 by the. Weber County property taxes must be brought in to our office by 5 pm. Steps to Pay Your Property Tax.

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Sales Taxes In The United States Wikipedia

Passports And Marriage Licenses Utah County Clerk Auditor

Utah Assessor And Property Tax Records Search Directory

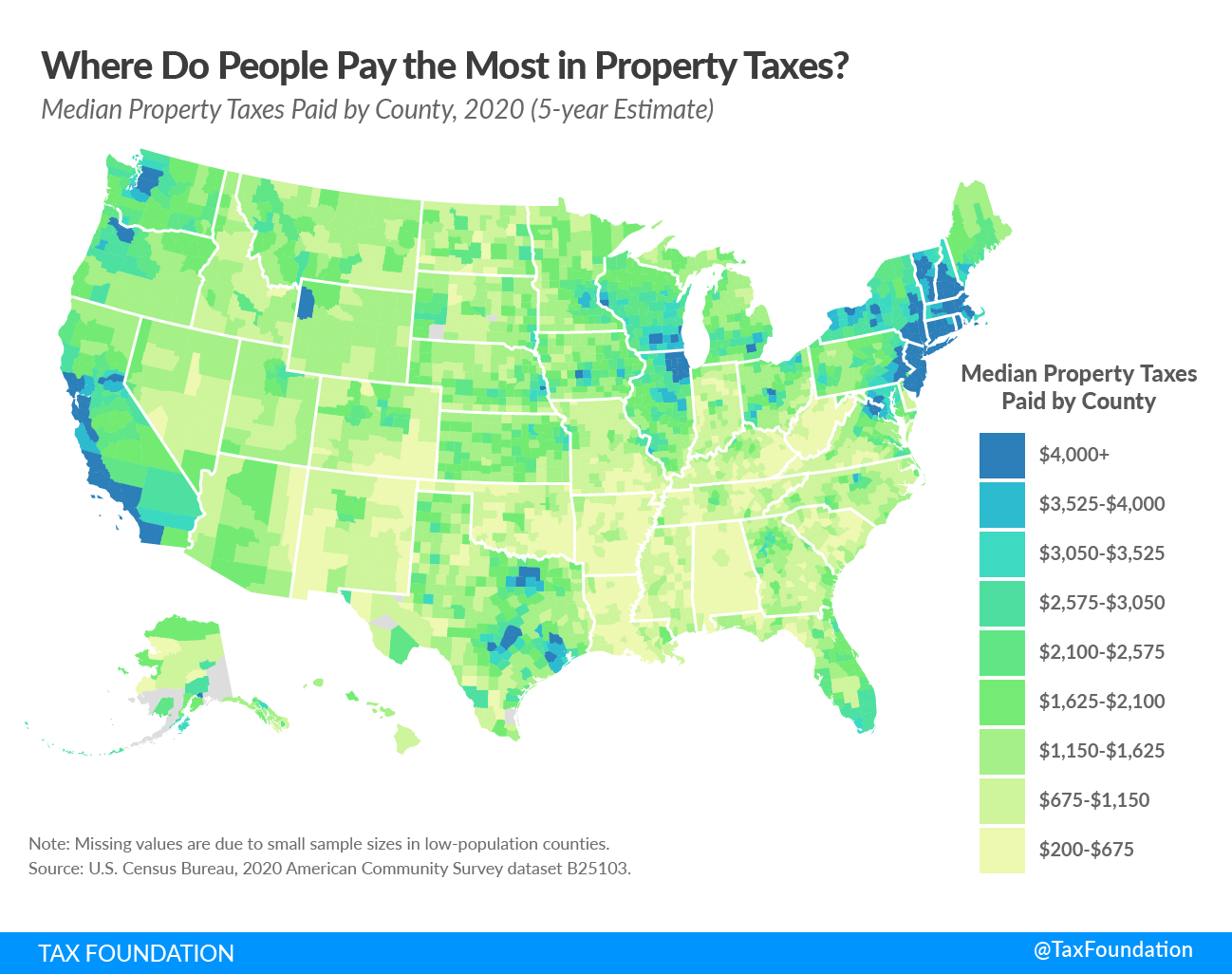

2022 Property Taxes By State Report Propertyshark

Property Taxes By State Quicken Loans

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Official Site Of Cache County Utah Paying Property Taxes

How Taxes On Property Owned In Another State Work For 2022

Fillable Online Tax Utah Cover Letter For Tax Commission Form Fax Email Print Pdffiller

Sales Taxes In The United States Wikipedia

Property Taxes Department Of Tax And Collections County Of Santa Clara

Utah Property Taxes Utah State Tax Commission

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

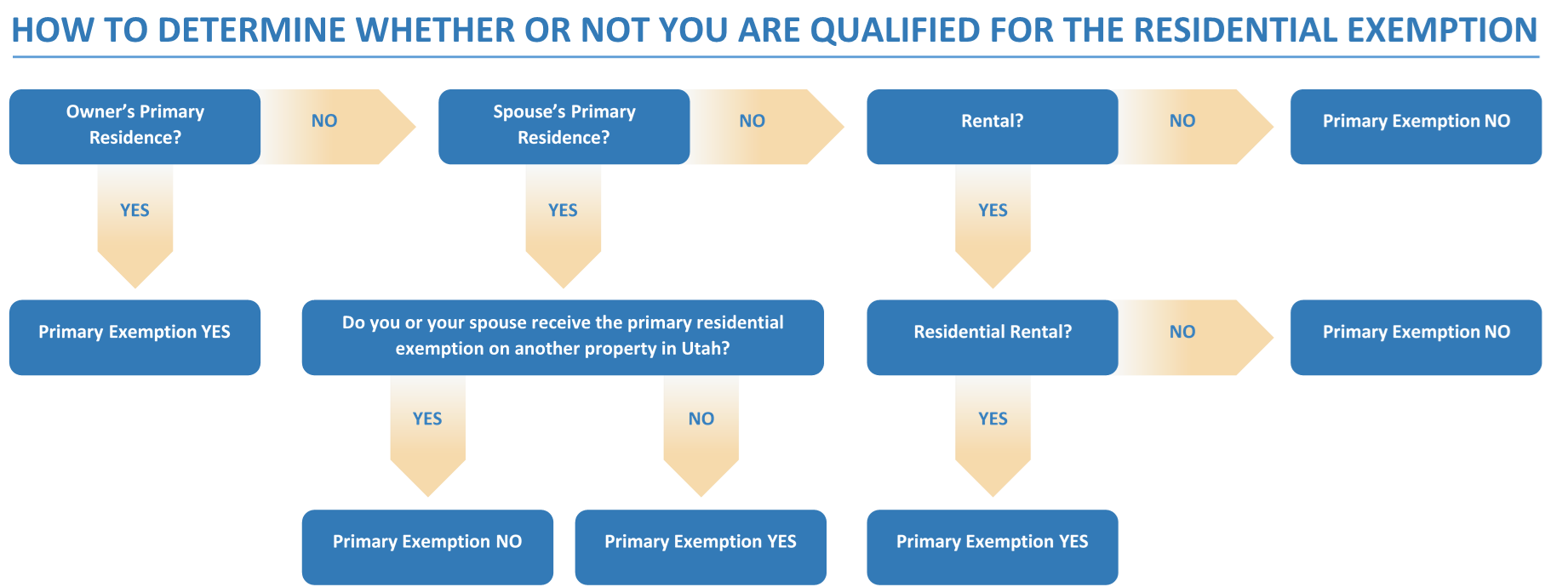

Residential Property Declaration

Fillable Online Tax Utah Utah State Tax Commission Lease Rental Sales Tax Affidavit To Be Used When Tangible Personal Property Is Leased For Exclusive Use Outside Of Utah State Of Utah County Of